Wonderful Info About How To Be A Good Credit Analyst

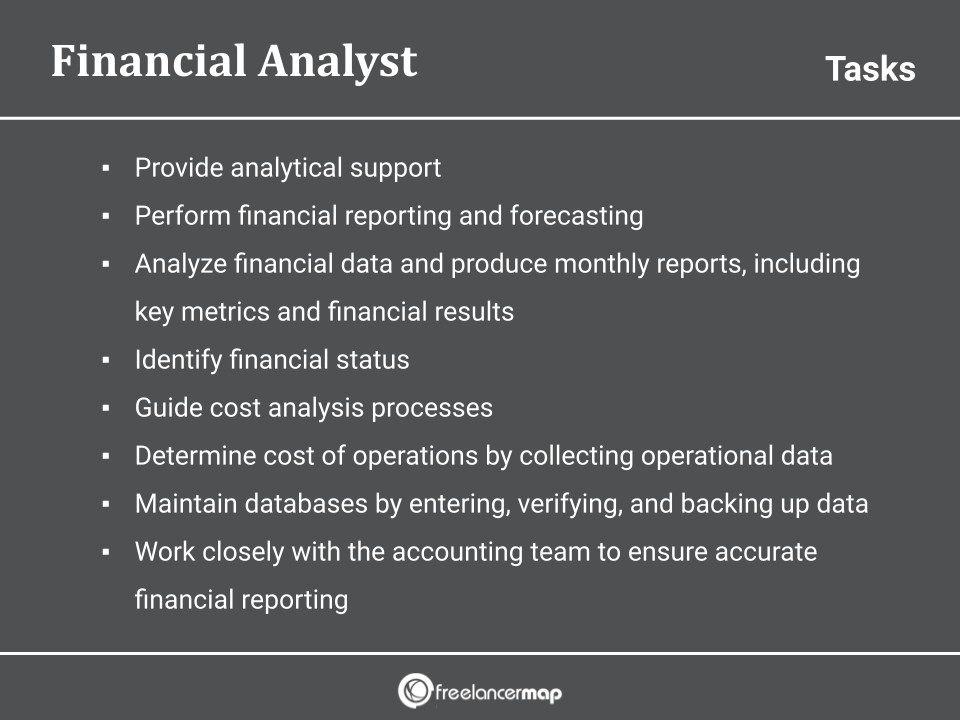

Adept at organizing, analyzing and reporting data.

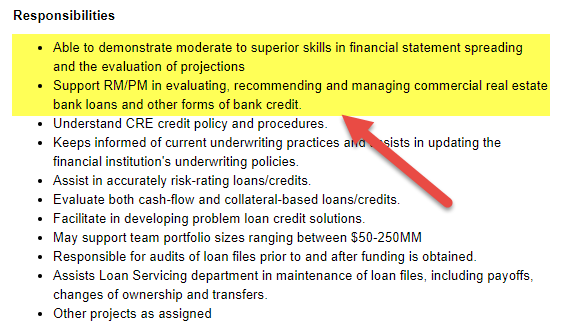

How to be a good credit analyst. Skills required to become a credit analyst. Customer service experience and proficiency with spreadsheets, databases, and. Fraud analysts work in organizations including insurance companies, banks, or realtors to detect and deter deceitful actions.

Full time, remote/work from home. Although some employers may prefer candidates to have a bachelor's degree, prospective certified credit analysts may also be able to earn their certifications by attending a. Knowing some basic functions, such as.

A degree in mathematics would also be. Many credit analysts will have skills in risk analysis,. A credit analyst needs to be able to work on multiple projects at the same time and prioritize them properly.

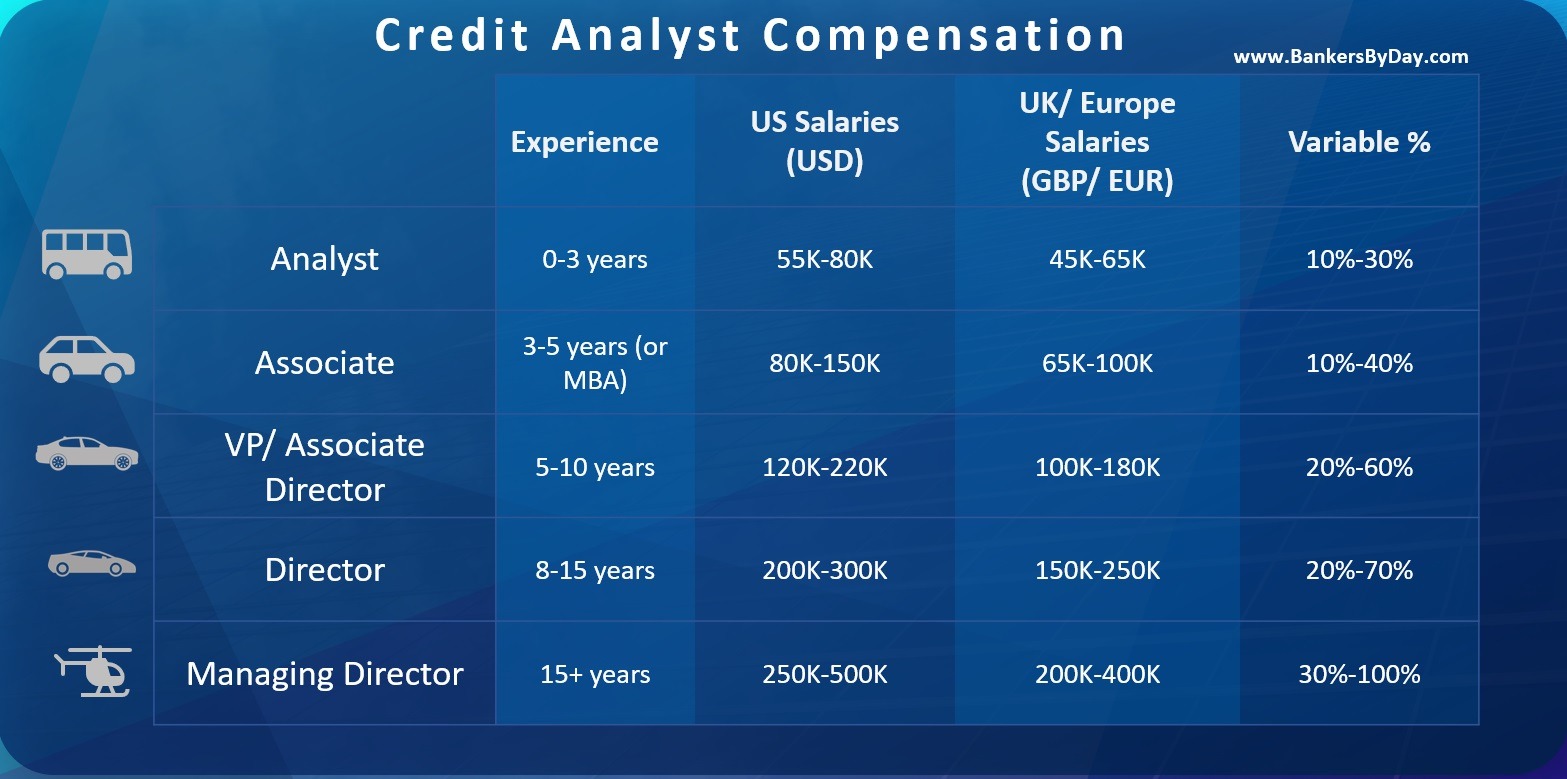

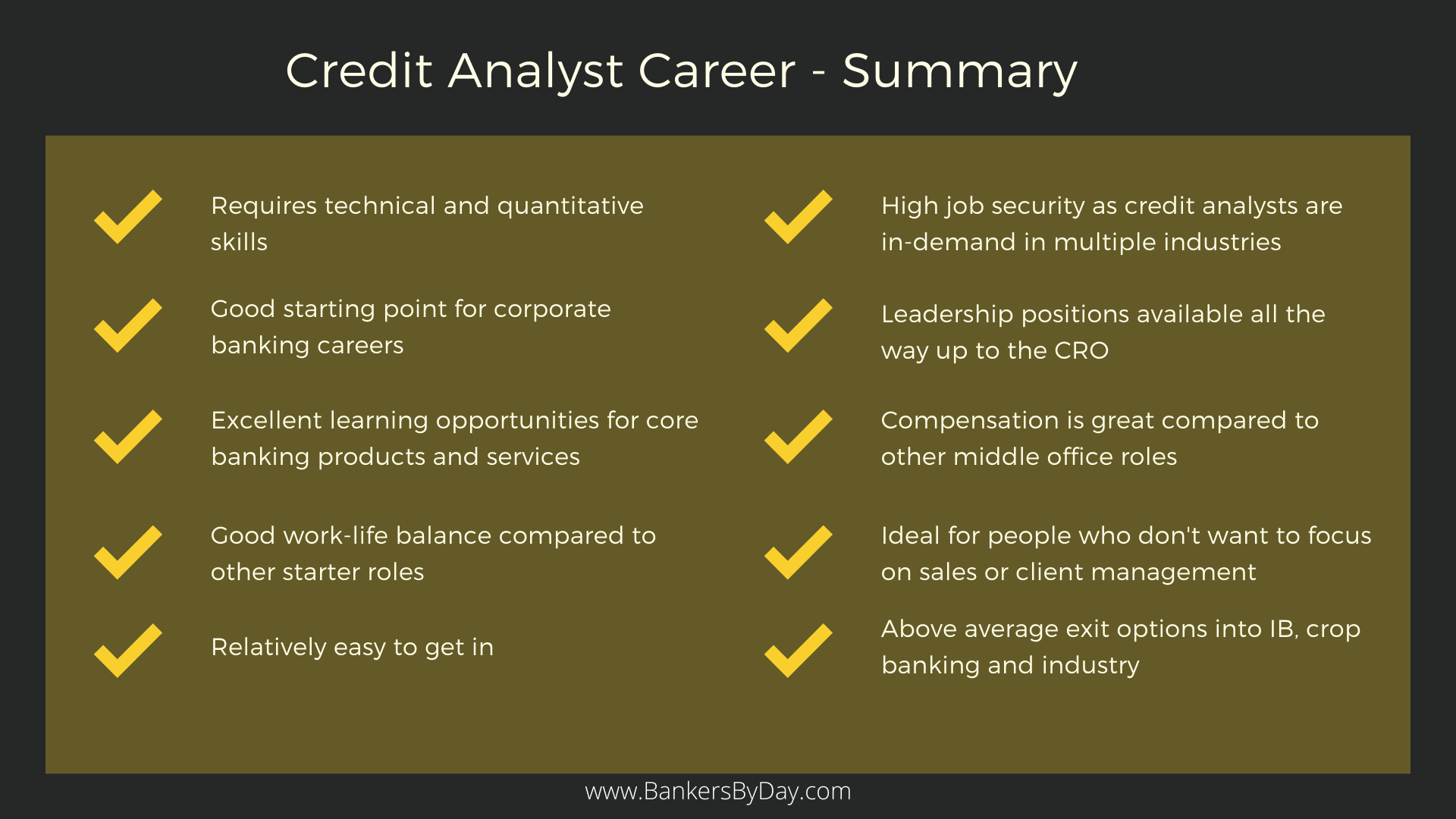

To become a credit analyst, you can follow these steps: Some credit analysts go on to other exciting financial paths, such as loan. Credit analysts also bring home a solid salary with good benefits and the opportunity for advancement.

A credit analyst should have accounting skills, such as the ability to create and analyze financial statements and ledgers. the first step in becoming a credit analyst is to understand what the job entails, as it’s not always a good fit for everyone. According to march 2015 job postings on monster.com, most employers look for credit analysts who hold a bachelor's degree in finance or a related subject, such as accounting, business.

Credit analyst must be comfortable with common financial software, such as microsoft excel, which they may use on a daily basis. They strive to resolve fraud cases including identity theft or. It’s important to understand what you are entering into.

.jpg)